Tether (USDT) has become a crucial player in the cryptocurrency market, serving as a stable alternative to the volatility often associated with digital assets. As a beginner in the world of cryptocurrencies, understanding Tether is essential for navigating the market effectively. In this article, we will explore what Tether is, how it works, and its significance in the cryptocurrency ecosystem.

What is Tether (USDT)? A Stablecoin Pegged to the US Dollar

Tether is a stablecoin, which means it is a cryptocurrency designed to maintain a stable value relative to a specific asset. In the case of Tether, it is pegged to the value of the United States dollar (USD) at a 1:1 ratio. This means that for every Tether token issued, there should be an equivalent amount of USD held in reserve by the company behind Tether, Tether Limited.

The primary purpose of Tether is to provide stability in the highly volatile cryptocurrency market. By maintaining a constant value of $1 USD per token, Tether allows cryptocurrency traders and investors to move funds between different cryptocurrencies without the need to convert back to fiat currency. This not only saves time and money on transaction fees but also reduces the exposure to price fluctuations during the trading process.

Tether has become one of the most widely used cryptocurrencies, particularly in the context of trading. Many cryptocurrency exchanges use Tether as a base currency for trading pairs, allowing users to buy and sell other cryptocurrencies using USDT.

The Mechanics of Tether: Issuance, Redemption, and Blockchain Infrastructure

Tether operates on a simple principle: for every Tether token issued, an equivalent amount of USD is held in reserve. When a user wants to obtain Tether, they send USD to Tether Limited’s bank account. Once the funds are received and verified, an equivalent amount of Tether tokens are issued and sent to the user’s cryptocurrency wallet. Similarly, when a user wants to redeem Tether for USD, they send the Tether tokens back to Tether Limited, and the company sends the equivalent amount of USD to the user’s bank account.

Tether is built on top of existing blockchain infrastructure, primarily using the Omni Layer protocol on the Bitcoin blockchain. However, Tether has also expanded to other blockchain networks, such as Ethereum and Tron, to increase its accessibility and usability across different cryptocurrency ecosystems.

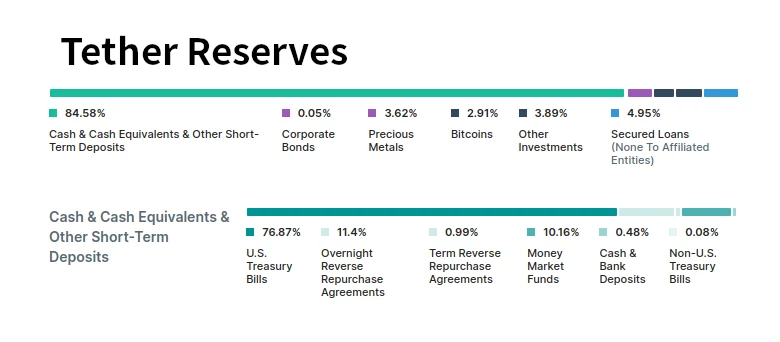

The company behind Tether, Tether Limited, is responsible for managing the issuance and redemption of Tether tokens, as well as maintaining the USD reserves backing the tokens. Tether Limited claims to hold all funds in reserve and to regularly undergo audits to ensure the 1:1 peg to the US dollar is maintained.

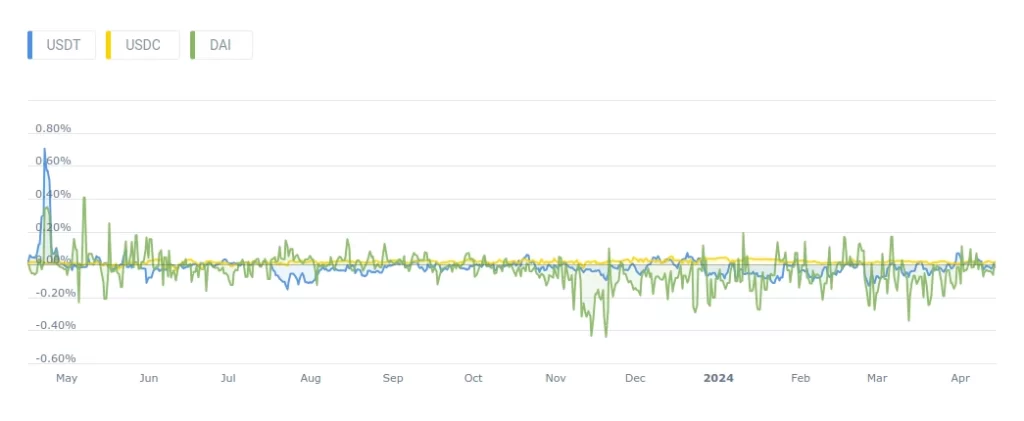

It is important to note that while Tether aims to provide stability and maintains its peg to the USD most of the time, it is not immune to market fluctuations and has experienced slight deviations from the $1 mark in the past.

The Benefits of Using Tether: Stability, Speed, and Facilitating Crypto Trading

Tether offers several advantages to cryptocurrency users, making it an attractive option for traders and investors alike.

Firstly, Tether provides stability in the highly volatile cryptocurrency market. By maintaining a constant value of $1 USD per token, Tether allows users to store value without exposing themselves to the price fluctuations commonly associated with other cryptocurrencies like Bitcoin or Ethereum. This stability is particularly useful for traders who want to lock in profits or move funds between different cryptocurrencies without the risk of losing value due to market volatility.

Secondly, Tether transactions are generally faster and cheaper compared to traditional banking transactions. Sending Tether between cryptocurrency wallets is usually completed within a few minutes, and the transaction fees are minimal. This makes Tether an efficient option for cross-border payments and remittances, especially in countries where traditional banking services are limited or expensive.

Lastly, Tether plays a crucial role in facilitating trading between different cryptocurrencies. Many cryptocurrency exchanges do not have direct trading pairs between all the listed tokens. Instead, they use Tether as a base currency, allowing users to trade various cryptocurrencies against USDT. This increases liquidity in the market and makes it easier for traders to enter and exit positions in different cryptocurrencies.

Tether Controversies and Risks: Reserve Backing, Transparency, and Market Manipulation

Despite its widespread adoption and usefulness in the cryptocurrency market, Tether has faced several controversies and risks that users should be aware of.

One of the main concerns surrounding Tether is the question of whether the company holds sufficient USD reserves to back all the Tether tokens in circulation. Critics have raised doubts about Tether Limited’s claims of full reserve backing, citing the company’s reluctance to undergo a comprehensive audit by a reputable third-party auditing firm. The lack of transparency regarding Tether’s reserves has led to speculation about the company’s financial health and its ability to maintain the 1:1 peg to the US dollar.

Another issue that has plagued Tether is allegations of market manipulation. Some critics have accused Tether Limited of issuing large amounts of USDT without proper backing to artificially inflate the prices of other cryptocurrencies, particularly Bitcoin. These allegations have led to investigations by regulatory authorities and have cast a shadow over Tether’s reputation in the cryptocurrency community.

Furthermore, Tether’s reliance on the traditional banking system exposes it to potential risks. In the past, Tether has faced challenges with its banking relationships, leading to delays in token issuance and redemption. If Tether Limited were to lose access to its banking partners, it could significantly impact the company’s ability to maintain its operations and the stability of the USDT token.

As with any cryptocurrency investment, users should be aware of the risks associated with holding and using Tether. While Tether has maintained its peg to the US dollar for most of its existence, there is no guarantee that it will always do so. Users should also consider the counterparty risk of trusting Tether Limited to manage the reserves responsibly and transparently.

Acquiring, Storing, and Utilizing Tether: A Step-by-Step Guide

If you’re interested in using Tether (USDT) for trading, payments, or as a stable store of value, you’ll need to know how to buy, store, and use it effectively.

Buying Tether

To acquire Tether, you’ll need to use a cryptocurrency exchange that supports USDT. Some popular exchanges that offer Tether include:

To buy Tether on an exchange, you’ll need to create an account, complete the necessary verification process, and fund your account with either fiat currency (like USD or EUR) or another cryptocurrency. Once your account is funded, you can navigate to the USDT trading pair (e.g., USDT/USD or BTC/USDT) and place an order to buy Tether at the current market price or at a specified limit price.

Storing Tether

After purchasing Tether, it’s crucial to store it securely in a compatible cryptocurrency wallet. There are several types of wallets that support Tether:

- Hardware Wallets: These are physical devices designed for secure offline storage of cryptocurrencies. Popular hardware wallets that support Tether include Ledger and Trezor.

- Software Wallets: These are digital wallets that can be installed on your computer or mobile device. Examples of software wallets that support Tether are MyEtherWallet (web-based), MetaMask (browser extension), and Trust Wallet (mobile).

- Exchange Wallets: Many cryptocurrency exchanges offer built-in wallets for storing Tether and other supported tokens. However, it’s generally recommended to store large amounts of cryptocurrency in a hardware or software wallet for added security.

When choosing a wallet, consider factors such as security, ease of use, and compatibility with the devices you own.

Using Tether

Once you have Tether in your wallet, you can use it for various purposes:

- Trading: You can use Tether to trade against other cryptocurrencies on exchanges that support USDT trading pairs. This allows you to potentially profit from price movements without having to convert your holdings back to fiat currency.

- Payments: Some merchants and online platforms accept Tether as a form of payment for goods and services. Using Tether for payments can be faster and cheaper than traditional payment methods, especially for cross-border transactions.

- Remittances: Tether can be used to send money internationally, as it can be easily transferred between wallets and exchanges. This can be particularly useful for people in countries with limited access to traditional banking services.

- Stable Store of Value: If you want to keep your cryptocurrency holdings stable without converting them back to fiat currency, you can convert a portion of your portfolio to Tether. This can help protect your funds from the volatility often associated with other cryptocurrencies.

When using Tether for any purpose, always double-check the wallet address you’re sending to, as transactions cannot be reversed once confirmed on the blockchain. Additionally, keep your wallet’s private keys secure and never share them with anyone, as they grant full access to your funds.

Tether’s in the Stablecoin Market: Capitalization, Volume, and Competitors

Tether (USDT) has established itself as a dominant force in the cryptocurrency market, consistently ranking among the top cryptocurrencies by market capitalization. As of August 2023, Tether’s market capitalization stands at around $80 billion, making it the largest stablecoin and one of the most valuable cryptocurrencies overall.

Tether’s trading volume is also substantial, with daily volumes often surpassing those of many other top cryptocurrencies. The high trading volume can be attributed to Tether’s widespread use as a base currency for trading pairs on numerous cryptocurrency exchanges. This liquidity makes Tether an essential component of the cryptocurrency trading ecosystem.

However, Tether is not the only stablecoin in the market. Other notable stablecoins include USD Coin (USDC), Binance USD (BUSD), and Dai (DAI). While these stablecoins share the same goal of providing a stable value pegged to the US dollar, they differ in their issuing entities, reserve backing, and transparency.

USDC, for example, is issued by Circle and Coinbase, with regular audits conducted to ensure full reserve backing. BUSD is issued by Binance, the world’s largest cryptocurrency exchange, and is also subject to periodic audits. Dai, on the other hand, is a decentralized stablecoin that maintains its peg through a system of collateralized debt positions and algorithmic mechanisms.

Despite the competition, Tether remains the most widely used and traded stablecoin, with its market position solidified by its early-mover advantage and extensive integration with cryptocurrency exchanges.

Regulatory Landscape, Competition, and Adoption

The future of Tether and stablecoins is closely tied to the overall development and adoption of cryptocurrencies. As the cryptocurrency market matures and gains mainstream acceptance, the demand for stablecoins like Tether is likely to grow.

However, the regulatory landscape for stablecoins is evolving, and potential changes could significantly impact Tether and other stablecoin issuers. Regulators worldwide are grappling with how to oversee and regulate stablecoins effectively, given their potential impact on financial stability and monetary policy.

In the United States, the President’s Working Group on Financial Markets has called for a comprehensive regulatory framework for stablecoins, including requirements for reserve backing, regular audits, and consumer protection measures. If such regulations are implemented, Tether and other stablecoin issuers may need to adapt their operations to comply with the new rules.

Furthermore, as the stablecoin market grows, competition among stablecoin issuers is likely to intensify. New entrants may emerge, offering innovative features or more transparent reserve backing. Existing players like USDC and BUSD may also gain market share, challenging Tether’s dominance.

Despite these challenges, stablecoins are poised to play a crucial role in the future of cryptocurrency adoption. As more individuals and institutions enter the cryptocurrency space, stablecoins like Tether can provide a stable entry point and a means of mitigating volatility risk. Moreover, stablecoins have the potential to revolutionize cross-border payments and financial inclusion, particularly in regions with unstable local currencies or limited access to traditional banking services.

Conclusion

In conclusion, understanding Tether is essential for anyone navigating the cryptocurrency market. As the most widely used stablecoin, Tether plays a vital role in providing stability, liquidity, and a gateway between traditional finance and the world of cryptocurrencies.

Throughout this beginner’s guide, we have explored the key aspects of Tether, including its purpose, how it works, its advantages, and the controversies and risks surrounding it. We have also discussed how to buy, store, and use Tether effectively, as well as its market position and future prospects.

While Tether has faced challenges and criticisms, its importance in the cryptocurrency ecosystem cannot be overstated. As the market evolves and matures, Tether and other stablecoins will likely continue to play a significant role in shaping the future of digital assets.

As with any investment or financial decision, it is crucial to conduct thorough research, understand the risks involved, and make informed choices based on your individual circumstances and risk tolerance. By understanding Tether and its place in the cryptocurrency market, you can better navigate this exciting and rapidly evolving space.